Organizations encounter a variety of issues in the quickly changing financial services sector today, which calls for effective and simplified solutions. The efficient processing of collections and disbursements is a critical component of managing financial activities. Many businesses are using specialized software programs called Financial Services Collections and Disbursements (FS-CD) to accomplish this. In this blog, we’ll examine the function of FS-CD in financial services organizations and consider how it could be able to address some of the most urgent problems.

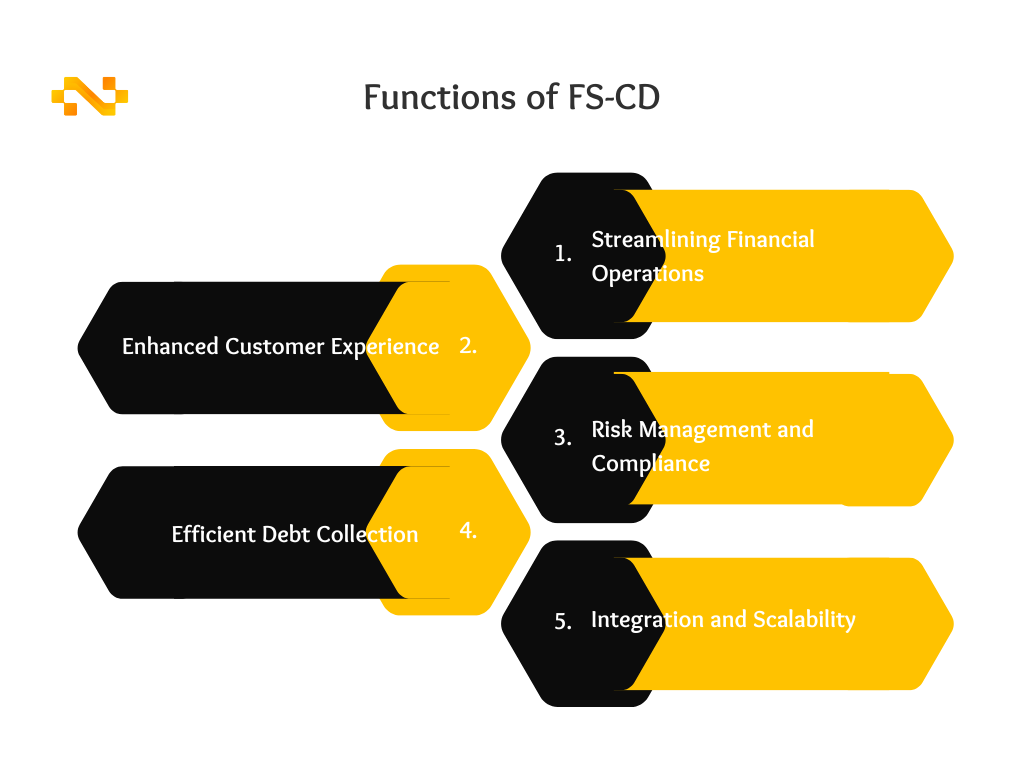

1. Streamlining Financial Operations:

Financial services organizations deal with vast amounts of data related to collections and disbursements. FS-CD acts as a central platform that consolidates all financial transactions, providing a comprehensive view of an organization’s financial operations. By integrating various systems and processes, FS-CD enables efficient data management, reducing errors, duplication, and manual intervention. This streamlined approach empowers organizations to achieve greater accuracy, transparency, and control over their financial operations.

2. Enhanced Customer Experience:

In the competitive financial services landscape, providing a seamless customer experience is paramount. FS-CD plays a crucial role in improving customer satisfaction by offering a range of features and functionalities. Through automated processes and self-service portals, customers can easily view their financial information, make payments, and track their transactions in real-time. By reducing complexity and enhancing accessibility, FS-CD fosters customer loyalty and strengthens relationships.

3. Risk Management and Compliance:

Compliance with regulatory standards and risk management are critical considerations for financial services organizations. FS-CD helps organizations meet these challenges by incorporating robust risk management features. It provides tools for monitoring and controlling credit risk, ensuring compliance with regulatory requirements, and enforcing strict security measures. By mitigating risks and adhering to compliance guidelines, organizations can safeguard their reputation and avoid costly penalties.

4. Efficient Debt Collection:

Debt collection is an essential function for financial services organizations. FS-CD offers powerful tools to streamline the debt collection process, enabling organizations to efficiently manage outstanding debts. It automates payment reminders, provides personalized customer communication, and offers flexible payment options. By optimizing debt collection procedures, FS-CD reduces the effort required, increases recovery rates, and improves overall financial performance.

5. Integration and Scalability:

Organizations in the financial services industry frequently function inside intricate IT ecosystems made up of numerous systems and applications. With the help of FS-CD’s integration capabilities, current systems like billing and customer relationship management (CRM) may be connected with ease. Through this integration, data consistency is guaranteed, silos are removed, and real-time information sharing is made possible. Additionally, the FS-CD’s scalability supports organizational expansion, enabling it to manage higher numbers of financial transactions without compromising speed.

In a rapidly evolving financial services industry, the role of FS-CD in organizations cannot be overstated. By streamlining financial operations, enhancing customer experience, managing risks, and improving debt collection processes, FS-CD offers practical solutions to meet the challenges faced by financial services organizations. Its integration capabilities and scalability make it an ideal choice for organizations seeking to optimize their financial processes. Embracing FS-CD can transform an organization’s financial operations, leading to increased efficiency, improved customer satisfaction, and sustained growth.

Incorporating FS-CD as a solution in your financial services organization can revolutionize the way you manage collections and disbursements. Explore the possibilities, understand your unique requirements, and take the leap toward a more streamlined and successful future.

Looking for expertise and excellent know-how in matters of SAP Contract Accounting and Payment Engine?

Aashish Garg

Managing Partner -Billing and Payments

17+ Years of SAP experience with core competencies in system & solution architecture, business process design, project management, account management, and finance transformation. Skilled in SAP Core Insurance Suite, SAP FS-CD, Payment Transactions, SAP CRM, SAP TM, SAP EM.

Industry exposure: Insurance, Transportation Management, Telecom, Retail, and Customer Relationship Management.